florida sales tax on new boat

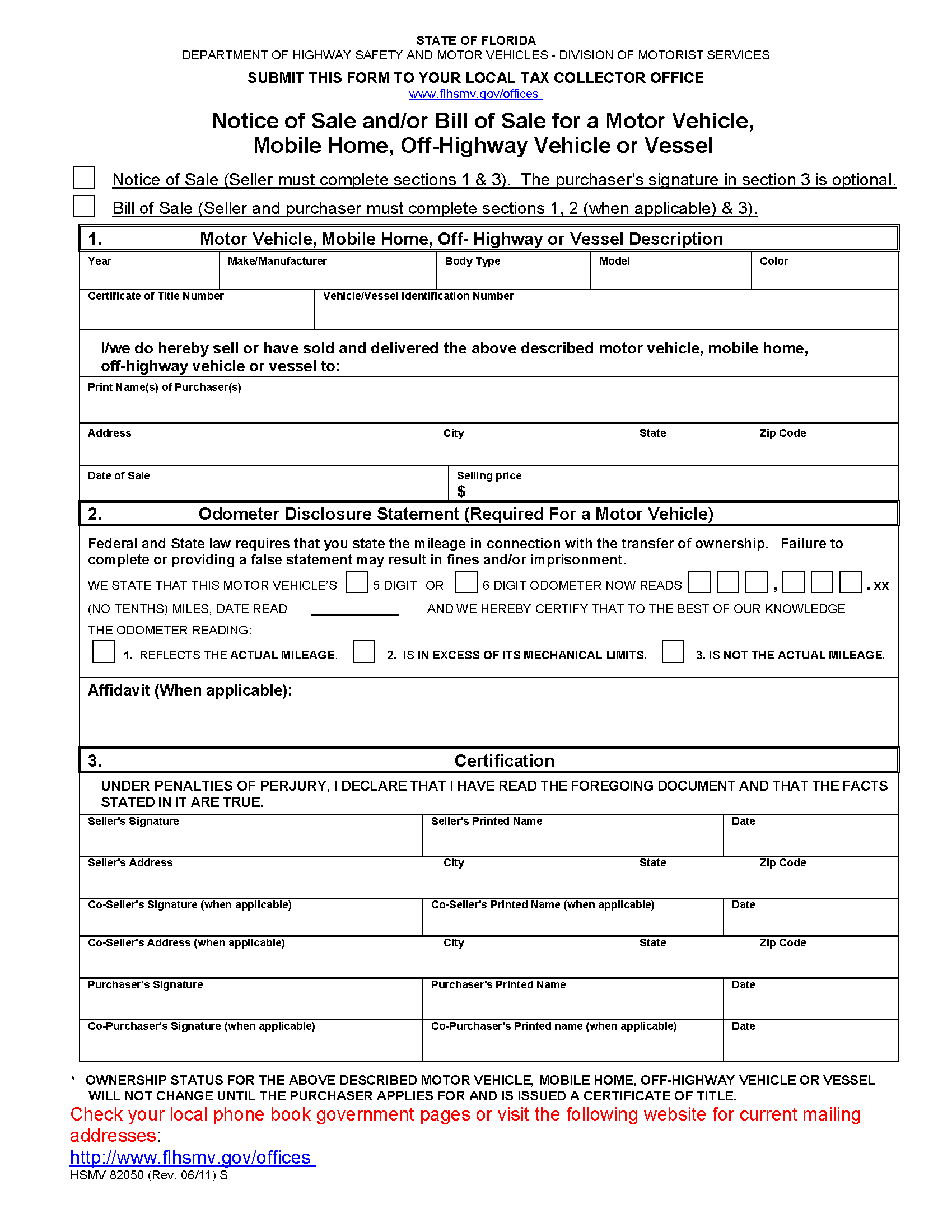

So you as the buyer will only pay sales tax on the boat itself to the DMV. Sales Tax Versus Use Tax for Boats.

U S Boating Boom Continues With Record 2021 Sales Strong Momentum In 2022 Business Wire

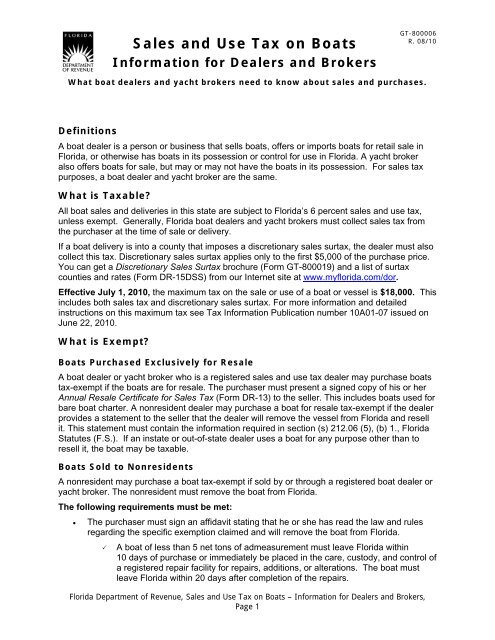

For more information and detailed instructions.

. Advisement 03A-051 Importing Boats Into Florida Solely for Sale in our online Tax Law Library. Boats Imported for Repair If sales or use tax has not been paid on a boat the boat is exempt. This figure includes all sales and use tax plus.

Specifically if a nonresident purchaser comes to Florida buys a boat and fills out the correct paperwork the purchaser. 1999 Carolina Skiff 16. North Carolinas boat sales tax is 3 and capped at 1500.

Well we held off as long as we could. Joined Jul 28 2018. Nevertheless there are circumstances in which legally avoiding sales and use taxes is a real possibility.

The current sales tax rate in Florida is 6. When it comes to flat rates the North Carolina sales. Our taxing district on Johns island is pretty low and just has the fire district mill levy.

12 Sep 12 2022 Edited In Ga you pay property tax on a boat and motor every year. In New York you would pay taxes on the first 230000 of. This includes both sales tax and discretionary sales surtax.

Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. The seller is responsible for collecting and remitting the sales tax to the Florida Department of Revenue. How do I avoid paying sales tax on a boat in Florida.

If you are planning to keep your boat in Florida for that kind of money it simply doesnt make sense to register your boat offshore. So for example if your bill of sale reflects 250000 but 75000 is separately itemize for the two 250. And none more confusing to most than FLORIDA.

State B welcomes you to the state but. The buyer is not responsible. For instance assume you paid tax on your 100000 boat purchase to your home state at a 6 rate or 6000.

I had to pay the property tax on a 2005 Landcruiser I brought down for the house. There is a lot of confusion surrounding sales taxes on boats. 4 on amusement machine receipts 55 on the lease or license of commercial real property and 695 on electricity.

Sales and use taxes on vessels are imposed. Floridas general state sales tax rate is 6 with the following exceptions. Sales tax is 7 of the.

Effective July 1 2010 the maximum tax on the sale of a boat or vessel is 18000. New Yorkers for instance pay sales tax on only the first 230000 of a purchase priceor 825 percent in most counties. The absolute maximum tax you can pay on the sale of a boat or vessel in the state of Florida is 18000 as of 2018 state tax rates.

But rates and qualifications are. You decide to take your boat to State B.

Used Boats For Sale In Miami Fl Used Boat Sales

Sales And Use Tax On Boats Florida Department Of Revenue

Tarpon Springs Florida C1959 Postcard Miss Milwaukee Deep Sea Fishing Boat Ebay

Sales Tax On A Boat Can You Avoid It

Boat Taxes All The Basics Boats Com

Free Florida Boat Bill Of Sale Form Pdf Word

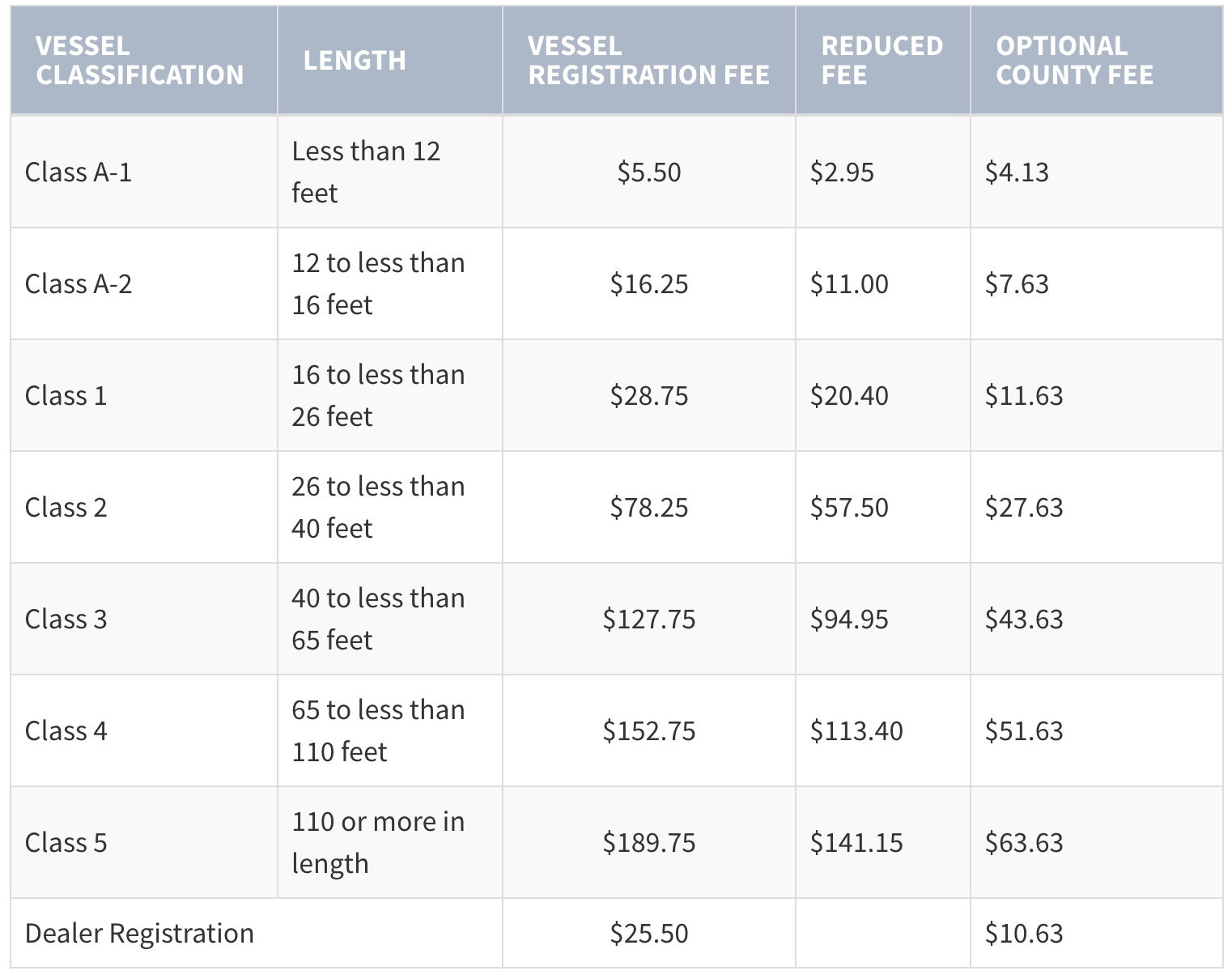

Boats Vessels Collier County Tax Collector

How To Register A Boat In Florida With No Title Detailed Guide

Florida Sales Tax And Outboard Engines Macgregor Yachts

How To Register A Boat In Florida With No Title In 6 Steps

Yacht Companies Tax Breaks Keep Sales Afloat

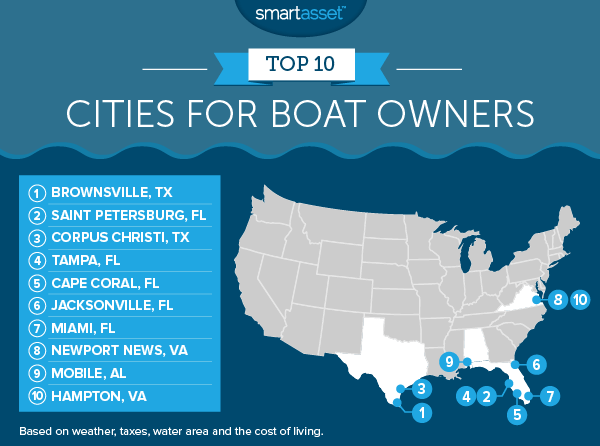

The Best Cities For Boat Owners Smartasset

Free Florida Boat Bill Of Sale Form Pdf Word Doc

Boat Registration Guide Florida Boatsmart Blog